Delayed payments and working capital crunch are words which any MSME owner lives with. Limited financial resources (credit history and collateral) forces MSMEs to take loans from informal sources. These informal sources which are money lenders extend loans at a very high rate of interest, to the tune of 26% to 35%. Such high rate of interest leads to further deterioration in financial health of the MSMEs.

With Govt. making an all-out effort to ensure ease of business and a thriving fintech sector, MSMEs have many new avenues to seek working capital loans such as NBFCs, P2P lenders and TReDS (Trade Receivables Discounting System) platforms. These new age lending avenues use alternate data points to create a credit history and appraise with a new approach.

In this article I will talk about TReDS, a new model which has acceptance of RBI and currently India has three operational platforms.

TReDS is a new concept in India and was floated by RBI based on based on the report of the Raghuram Rajan Committee on Financial Sector Reforms in 2008. Then, the RBI appointed a working group which submitted its report in November 2009. It then issued a concept paper in 2014. This was followed up with the draft and the final guidelines.

TReDS is an electronic platform that allows a transparent and online trading of receivables. This process is commonly known as bill discounting, where a financier, typically a bank, buys a bill from the seller of goods before its due or before the buyer credits the full value of the bill. In other words, a seller gets credit against a bill which is due to him at a later date. The discount is the interest paid to the financier.

One of the major reasons for introduction of TReDS was to ensure timely payments to MSMEs, allowing them to access credit at an interest rate which would be offered to their buyers. The other reason for bringing TReDS was to provide MSMEs an alternate source of creating credit history. With the implementation of GST, there is a tremendous amount of data which is being generated and further helping MSMEs in creating a digital footprint. The result of all these initiatives would be to enable financial inclusion of MSMEs. There is statistical evidence of the important role MSMEs play in creating jobs and contributing to GDP.

Let us understand this process better and know how factoring benefits the MSMEs. invoicemart , the TReDS platform promoted by invoicemart Ltd. , offers both Factoring as well as Reverse Factoring of invoices.

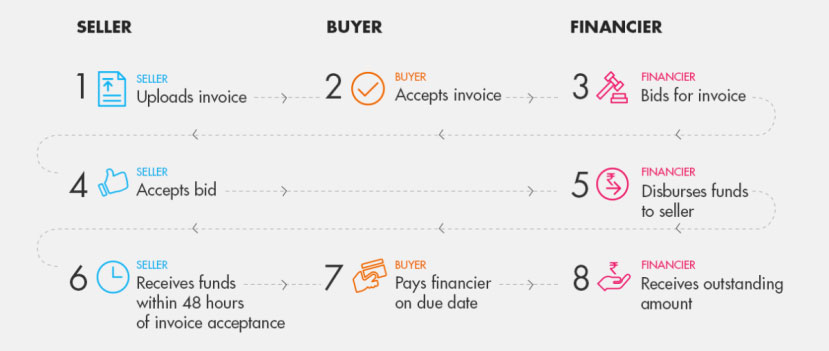

Factoring:

A factoring transaction begins when a Seller uploads an invoice on the platform and creates a Factoring Unit (FU). An FU contains necessary details of the invoice in digital format and must be accepted by the Buyer before it is sent to Financiers for bidding. The Seller then chooses the most suitable bid and receives funds from the Financier within 48 hours. On the due date of payment, the Buyer pays the outstanding amount to the Financier.

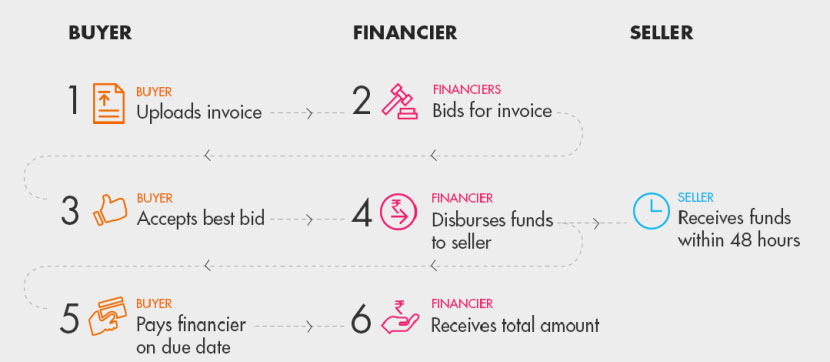

Reverse factoring

A Reverse Factoring transaction begins when a Buyer uploads an invoice on the platform, on behalf of the Seller and creates a Factoring Unit (FU). An FU contains necessary details of the invoice in digital format which is sent to Financiers for bidding. The Buyer then chooses the most suitable bid. The Seller receives funds from the Financier within 48 hours. On the due date of payment, the Buyer pays the outstanding amount to the Financier.

A buyer is a large corporate, seller is the MSME and the financier is a bank or an NBFC Factor. All three of them are required for the factoring transaction to be completed.

Advantages

It is imperative to understand the benefits of a platform like invoicemart over regular bill discounting. Firstly, an online platform allows the seller multiple Factors (financiers) to choose from. The seller is not restricted to one Factor that he visits or he has an on-going relationship with. The process of uploading an invoice is paperless and the seller does not require uploading the documents multiple times. Apart from one-time registration the whole process is paperless and allows the seller to choose from variety of interest rates offered by the financiers on-board the TReDS platform. It is without recourse to the Seller and does not require any collateral.

The lowest interest rate would be an obvious choice and this allows the seller to get the best deal in the most transparent manner which would have been impossible had he taken the traditional method of bill discounting/factoring.

It is practically impossible for a MSMEs owner to visit ten different bank branches in order to get the best rate. With an electronic TReDS platform at his disposal, he can sit at the comfort of his office and find the most competitive rate, spending more time in growing his business rather than finding sources of finance.

In its present set up, a buyer (a large corporate) needs to refer the sellers (MSMEs) which are to be on boarded onto the TReDS platform. This is due to the fact that invoice discounting essentially becomes an unsecured loan. The seller gets the funds on the basis of buyer’s credit rating without any collateral. The funding through the TReDS platform qualifies under priority sector lending and is beneficial for financiers ad they get a high quality portfolio at relatively low cost, hence it a model which is beneficial for all the participants.

We are very thankful to the Finance Ministry and the RBI in providing unstinting support to the TReDS platforms and creating an enabling atmosphere which would result in a fertile ecosystem.